The concrete paver market is up, and paver manufacturers continue to improve their technologies despite the lack of a long-term infrastructure solution.

And yes, that last statement seems to haunt every installment of a concrete paver Buying File.

“The concrete paver market is moderately up right now,” says Stephen Bullock, COO of the Power Curbers Companies (Power Curbers and Power Pavers brands). “We’ve seen a lot of activity in Asia as well as domestic demand in a variety of paving applications, ranging from roads in residential and industrial developments to agricultural applications.”

Kevin Klein, VP of engineering/research and development for GOMACO, also describes the market as up for concrete paving equipment. “It has been a very good year for all manufacturers, and all indications are that it will be strong into 2019,” he says. “I think the biggest factor is likely the strong economy in North America this past year. It helps contractors make the decision to move forward with purchases they may have been putting off for the past few years.”

Tim Nash, director of Concrete Products, Wirtgen America, is even more bullish.

“The concrete paver market is up in 2018 and each and every sub-market within—such as residential curb/gutter, road/highway, and airport—are up across the board,” he says. “New housing construction, continued spending on airport expansion, and road construction in some key concrete states have created market conditions similar to pre-2008 levels.”

“Pre-2008 levels” is high praise indeed, but the industry still lacks the long-term security that would come with a long-term highway bill.

Funding challenges

Though President Trump’s stated desire to spend $1 trillion on infrastructure—including highways—was lauded in construction circles, it remains a pipe dream.

One wonders how much better the concrete paving equipment market could be with an influx of federal spending for highways and a few years of certainty for contractors. Manufacturers, predictably, say it can be much better.

“Much of what we’ve seen in recent years is paving in street rehab projects, which is challenging for contractors,” Bullock says. “Ideally for our customers, and for us as a manufacturer, would be more funds committed to new roads and highways.”

Bullock would also like to see legislation beyond the recent spate of short, quick fixes. “Having a long-term element to the bill would make it easier for contractors to plan for future projects, and in turn, have the confidence to commit to purchasing new machinery,” he says.

“An ideal infrastructure bill would be a prioritized, long-term, comprehensive plan that is streamlined with regard to bureaucracy and accelerated permitting with increased levels of state, municipal, and private funding,” Nash says.

“Quite simply, an ideal infrastructure bill has to be funded,” Klein says. “It should be easy to pass a bill on infrastructure spending in a bipartisan manner because it is such an important need for our country. If we get a bill that is properly funded, I believe the concrete paving industry is well positioned to provide a quality product. If the bill isn’t funded, it makes it more difficult for the concrete industry to compete, because so much of the funding in place would go into temporary repairs and not permanent solutions such as concrete.”

Klein thinks the time may be right for a gas tax increase.“I believe there is growing willpower in the Congress to either raise the user’s fee on fuel, or implement some other kind of funding mechanism such as VMT,” Klein says. “I also believe the people of this nation are willing to pay something for a well constructed and funded transportation program.”

The concrete paving category is a relatively small-volume business with few major players, particularly when compared with other equipment categories. So much so that trend guru Chuck Yengst, president of Yengst & Associates, does not publish data on it.

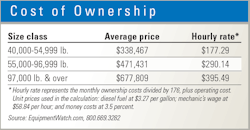

EquipmentWatch tracks cost-of-ownership data, however, and their numbers represent a notable change from last year. Although machine prices in the size classes did not rise appreciably, the hourly operating costs did. Last year, pavers with operating weights between 55,000 and 97,000 pounds cost $277 an hour to operate; this year pavers that same size cost $290 an hour to run.

It doesn’t appear that the units themselves, or their ever-increasing technologies, are to blame. Rather, each operating unit price in the EquipmentWatch equation—diesel fuel, mechanic’s wage, and money cost—was higher in 2018.

Trends in the market

Costs are a factor as more contractors move to stringless paving. “We continue to see more contractors moving to stringless controls,” Bullock says.

He cites the lack of skilled help as a factor.

“As the labor shortage becomes more widespread, eliminating stringline setting becomes more and more appealing to contractors,” Bullock says. “Stringline elimination allows the contractor to set up the pave faster and reduces the need to go back to remove stringline afterward, which both saves money and speeds up the entire process.”

“If we were to single out the mid-range pavers, which is the bulk of the market, contractors are leveraging a number of Wirtgen paving system features to increase production, reduce operating costs, optimize paving smoothness, and reduce transport time and transport costs,” Nash says. “These are core design parameters on all of our equipment. These parameters center around four key areas of paver design: mold design, control system, frame architecture, and component attachments.

“At some level, the entirety of all the features tie together to create a comprehensive paving solution, but we can single out a few in particular that have received the most attention,” Nash says. “First, the trio of mold design/control system and Super Smoother offers optimized smoothness which translates into less labor behind the paver, smoother rides, and less grinding, and it also increases potential for bonus pay.”

Nash says that the company’s frame architecture and attachments are designed to reduce mobilization time and haul costs. “The entire paver is capable of transitioning from paving-to-transport-paving without removal of paving kit items,” he says. “This means that end-users spend less time moving and setting up, and more time paving. In short, it’s new paving technology that offers contractors the means to deliver projects faster, more efficiently, and pursuant towards higher levels of quality.”

GOMACO’s Klein also touts the technology trend.

“The fundamental principal of concrete slipform paving has changed very little over the past few years, but what has changed is the technology being used to control our pavers,” Klein says. “We have seen rapid adoption of technology with implementation of our G+ control system, and even before that, we were early adopters of 3D machine guidance across our entire platform of equipment.

“By integrating our G+ system with 3D guidance, we’ve made it even easier for our contractor users to adopt 3D stringless controls, which has many obvious time-saving and quality-control advantages,” Klein says.

“By incorporating real-time smoothness on pavers with our GOMACO Smoothness Indicator system, paving crews can improve their paver and crew performance, setting them up to receive the maximum project incentive bonus for each job,” Klein says.

“Incorporating other features into the paver’s main controls such as vibrator monitoring, and actually vibrator speed control related to paving speed, also proves beneficial to producing the best possible concrete pavement,” he says.

Klein notes that all of this information can be monitored through the GOMACO Remote Diagnostics telematics system, in the office or on a smart phone.