Tom Foss is starting to hear the threats just when the teasing appears to be coming to an end.

For years, Congress had played with the minds of those in the road and bridge industry regarding the passage of a multiyear highway bill. Hope would build and then be snuffed out in the form of another funding extension.

Recent developments on Capitol Hill had anticipation finally feeling like realization. After members of the House and Senate came together and agreed on a five-year, $305 billion bill, called the Fixing America’s Surface Transportation (FAST) Act, both chambers quickly passed the measure. President Obama signed it into law on Dec. 4.

Construction Sector Reports

Back in California, Foss, who leads Griffith Co. in the city of Brea, is eager to see an influx of federal dollars funnel through, but he also is making sure his operation is running a tight ship, otherwise it could be raided by a new band of fines.

New storm-water regulations will be enforced in California, and will require transportation contractors to use silt fences, sand bags, straw wattles, and bales of hay to prevent runoff from the job site from entering the state’s water system.

Two other requirements affect the labor end of the operation. One is a federal rule calling for the hiring of local workers.

Griffith Co. has projects all over southern California, and when they enter a city or town they must actively pursue the laborers in the area. When Foss has to rotate people in and out to meet local hiring regulations, it affects his production. Another rule, which requires workers to take a 10-minute break for every four hours of work, has been in play since 2002, but many contractors such as Griffith are still trying to make sure everything is properly documented. Foss could have hundreds of workers covering a 16-mile project, so the process is extremely difficult. Every week or so each crew member is required to sign a document stating that they have been receiving their breaks.

The now infamous and more stringent air-quality regulations from the California Air Resources Board (CARB) also loom on the horizon. Like most contractors, Griffith Co. is in the process of replacing or retrofitting its fleet of equipment so that all machines have Tier 4-Final engines.

Despite the pressure of the law, Griffith Co. had a solid year in 2015. The Orange County contractor was expected to register $300 million in volume. As for 2016, Foss is expecting more of a normal construction season, which is about $200-$230 million in volume. Griffith and Co. could benefit slightly from the new federal multiyear bill, but it will not come in the form of new jobs until the tail end of the year. Currently, Griffith is handling a lot of work that was awarded over the past two years, and for most of 2015 cities and counties were slow to advertise new jobs because of the funding situation in Washington.

“Getting a bill I think will allow the city and county agencies to begin to put out their projects, and that will ease up everything for a company like ours as far as competition and things like that,” said Foss. “There will be more work, and the contractor pool will just get spread a little further so there will be less bidders on every job.”

For bridge contractors in the state of New York, the funding pool received some needed depth in 2015. New York’s Critical Bridges over Water (CBOW) initiative was fed with billions of dollars, with some coming from Housing and Urban Development and even more from bank settlements. Gov. Andrew Cuomo also supplied New York City and its Metropolitan Transit Authority with $8.3 billion, and a group called Rebuild New York called for funding parity.

“If the MTA needs $25 billion over the next five years, we are saying the highway guys upstate need $25 billion over the next five years,” Jeff DiStefano, co-owner and CEO of Harrison Burrowes Bridge Constructors, said. “Ten years ago, we had close to parity with the MTA and then through some governor and assembly leader changes it kind of fell off track.”

You might say Harrison Burrowes is a VIP of New York’s bridge bash. The company experienced 20 to 30 percent growth last year compared to 2014, and the backlog is full for 2016.

One of the 2016 projects is a design-build joint venture, which falls under CBOW, that involves 18 bridges, and there are two more jobs that will involve single structures.

A part of Harrison Burrowes’ profit will turn into investment, especially on the equipment side. DiStefano said six to eight pieces were new in 2015, and four to six pieces could be bought in 2016 if revenues continue to be on the upswing.

“We are a little bit concerned about next year with the ongoing projects in the Hudson Valley,” said DiStefano. “There is...a lot of work down there in the Hudson Valley, and I’m questioning if the unions can supply the help that we need.”

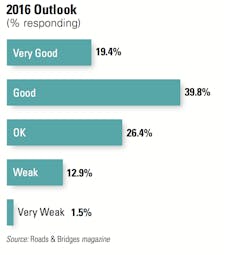

As a whole, contractors in the road and bridge industry have not been searching for many answers when it has come to generating capital. According to the most recent state of the industry survey conducted by Roads & Bridges, almost 70 percent of respondents rated 2015 as either a “good” or “very good” year, and almost 60 percent said 2016 will be a success as well. More money could be on the table, too. When asked if they expect bid prices to go up, down or stay the same in 2016, more than 57 percent said they believe the prices will go up.

Alison Premo Black is the chief economist for the American Road and Transportation Builders Association (ARTBA) and puts together a market report every year. Her numbers showed 7 percent growth in the road and bridge industry for 2015, and most of the contractors are feeling better about the business climate.

“They feel like things are returning to more of a normal market,” Premo Black said. “After 10 years of short extensions, the industry also has adapted. This has been the new normal, so I think to a large extent that mentality has been adopted by the industry.”

Breaking it down, according to ARTBA, which looks at the value of construction put in place, work in the highway sector (pavements) ended up at $55.9 billion in 2015. The average since 2000 has been about $60 billion, but it was as low as $51 billion in 2013.

On the flip side, bridge work continues to do its best work. The value of construction put in place for 2015 was $33.3 billion.

Construction activity in Florida, New York, Indiana and California was particularly high in 2015, but contract awards were up in almost half of the states. Big projects stoked the overall numbers.

Even with a long-term highway bill, ARTBA is only projecting 3.9 percent growth in the road and bridge market in 2016. Premo Black believes the recovering economy will play a larger role than will a new dose of federal funding. ARTBA is predicting $58.1 billion worth of work in the highway sector and $34.6 billion for bridges in 2016.

Funding is still falling far short of what is needed to address an overall network that remains in critical condition. According to the R&B survey, 53 percent of respondents said the urban roads in their state are “fair” and another 22.3 percent said they are “poor.” Furthermore, over 65 percent said the condition has declined over the past year. The numbers are not much better for rural roads (49.8 percent in fair condition; 67.3 percent said it declined since 2014) and bridges (65.5 percent of respondents said 16 percent or more of spans are structurally deficient).