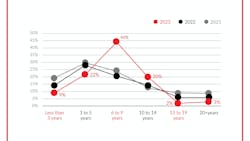

Nearly half of respondents to a recent survey said the average age of service vehicles in their fleets is six to nine years. According to VMAC, who commissioned the research, the results indicate a “spike.”

“Our findings indicate a notable increase in the average age of service vehicles,” said Mike Pettigrew, marketing manager, in a statement. “Fleets are getting older, and the chassis shortage has forced fleets to adapt by operating fewer trucks in the fleet or purchasing used vehicles.”

VMAC markets mobile air compressors and power systems commonly used on service trucks.

In 2023, two-thirds of respondents (66%) said that the average age of their service trucks was between three and nine years; 44% said average age fell between six and nine years. In 2022, about 50% reported similar age groupings, with 20% saying trucks were averaging between six and nine years old.

Of those impacted by the chassis shortage, 64% said they cannot replace aging trucks, a figure identical to the previous year’s survey. The proportion of fleets operating with fewer trucks due to their inability to replace aging vehicles has increased from 21% to 30% in the last year, according to VMAC.

The most popular truck type among respondents continues to be Class 2/3 trucks, with 61% saying that they have them in their fleets compared to 60% in 2022. About half (52%) said that they have Class 4/5 trucks in the fleet, down from 36% in 2022. Other size classes remain consistent with 2022 results: 22% have Class 6/7; 11% have Class 8 trucks.

Segmented by industry, construction, equipment repair, forestry, landscaping, mining, municipal infrastructure, oil & gas, and utilities infrastructure are more likely to have Class 4/5 than Class 2/3 service trucks in their fleet, according to VMAC.

Read also: Kenworth Service Truck Set for Serious Tasks

The percentage of respondents using service vans increased in 2023. About half (47%) have at least one van in the fleet, up from 36% in 2022. Some 27% said that they have one to five vans, up from 23% in 2022.

As alternative fuels have become available, so has the interest among respondents. About half (51%) plan to power future purchases with diesel, down from 72% in 2021. Hydrogen is the most popular alternative with 12% expressing interest in this fuel type for future purchases, up from 0% in 2021. Electric power is of interest for 11% of respondents, down from about 14% in 2022.

About half (53%) of respondents said that they were concerned about the range of electric service trucks, and 49% cited concern about the lack of charging stations. About one-third (36%) said that charge time was too long.

Respondents to the survey numbered 331, according to VMAC. Four in 10 respondents said that they were in equipment repair, and 39% said that they were in the construction industry. They were able to indicate more than one industry.