Parts and Service Use: Are You Normal?

Internal data and benchmarks are one thing, but have you ever wondered where your fleet stands versus your peers on items such as parts purchasing, outsourcing maintenance, and component durability?

You’re in luck. Long-time industry market research and management consulting firm MacKay & Company has compiled data on a host of parts and service-related practices.

The firm has a large database of owners and maintainers of construction equipment, commercial trucks, and farm equipment, as well as parts and service suppliers. These snippets of data are from a presentation at a recent AEMP meeting.

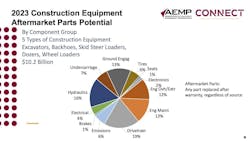

“The aftermarket parts potential for the construction equipment industry was $10.2 billion in 2023,” says John Blodgett, VP for MacKay. It used five prominent equipment categories in reaching that number: excavators, backhoe loaders, skid steers, crawler dozers, and wheel loaders. Aftermarket parts was defined as any part replaced after warranty, regardless of source.

Parts for drivetrain and hydraulic systems are the most purchased, at 19% and 16%, respectively. This is followed by engine maintenance and ground engaging tools, both at 13%.

Who's fixing what?

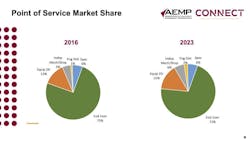

Blodgett and MacKay compared its 2016 and 2023 surveys for point of service market share and found that end users are doing a little less of their own maintenance. In 2016, MacKay found that end users did 75% of their own service. That figure dropped to 71% last year (see slide below).

Two of that 4% went to equipment dealers, one went to independent mechanics/shops, and one went engine distributors.

Comparing the type of services most outsourced, it’s no surprise: 91% of end users change their own filters while only 51% perform internal engine work. The equipment dealer performs 29% of engine work. The rest is split between independent mechanics/shops, engine distributors, and specialists.

“Lack of technicians, diagnostics, technology, and extended warranties are behind the outsourcing of more service work,” Blodgett says. “If this trend continues, maintenance managers are concerned about service providers keeping up.”

Two factors stand out—turnaround time and quality of work.

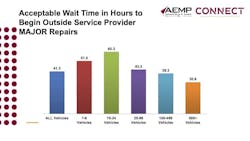

Specifically, MacKay found a threshold of what’s an acceptable wait time for outside service providers to begin major repairs and those wait times vary by number of units in the fleet (see nearby slide).

The larger the fleet, the less tolerant it is on the wait time to begin major repairs.

However, the research firm has found that overall, there is more patience on the time units travel for repairs and the distance they will travel, depending on the type of service.

"There seems to be a one-hour limit on the distance of outsourcing service, as well as a 40-mile limit on how far users will send a unit," Blodgett says.

Component life: How do you rate?

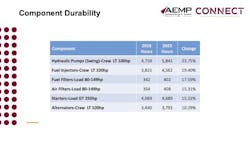

There has been a significant increase in durability for certain components, at least on crawlers and loaders (see nearby slide), with hydraulic pumps for 100-horsepower crawlers leading the way.

These significant changes in percentage are likely seen for a couple of reasons. First, users are stretching service out and keeping machines longer, and second, manufacturing technology has continued to incrementally improved.

What are you finding? Email us below.

About the Author

Frank Raczon

Raczon’s writing career spans nearly 25 years, including magazine publishing and public relations work with some of the industry’s major equipment manufacturers. He has won numerous awards in his career, including nods from the Construction Writers Association, the Association of Equipment Manufacturers, and BtoB magazine. He is responsible for the magazine's Buying Files.