Market demand across nearly all lubricant categories held tight to levels seen in 2022, according to a survey by market research specialist MacKay & Company.

The firm's 2023 U.S. Lubricant Market Report focuses exclusively on construction equipment and seven lubricant categories: engine oil, hydraulic fluid, gear oil, coolant, transmission fluid, and diesel exhaust fluid (DEF).

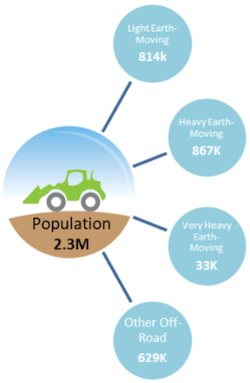

One of the critical components used to determine total market demand for lubricants is the population of equipment in operation, summarized into four primary duty classifications above. Annual changes to the overall population are typically very low, the report said, and in 2023 there was almost no difference compared to 2022.

Another component to market demand is the capacity usage by equipment type, measured in average annual hours. Construction equipment usage across all types dipped 1% in 2023.

Read also: Fleets Boost 2024 Budgets in Response to Inflation, Supply

Excluding DEF, the total market demand for lubricants reflects the usage changes and finishes the year with a -1.5% change. With DEF included, total demand is up by over 3%.

“Over the last two years, fleets have been replacing equipment they were unable to retire due to the pandemic and supply chain issues," said Brian VanCamp, data analyst and author of the report. "These machines include emission systems not required on the older units, which in turn, leads to an increase in the demand for DEF.”

Along with equipment categories, the DataMac Lube service profiles the U.S. market by several key categories including fleet size, region, vocation, distribution channels, points of service, and brands used. Survey with equipment operators and companies are conducted annually to capture up-to-date fleet behaviors as they pertain to the total market, measured in millions of gallons.

About the Author

Frank Raczon

Raczon’s writing career spans nearly 25 years, including magazine publishing and public relations work with some of the industry’s major equipment manufacturers. He has won numerous awards in his career, including nods from the Construction Writers Association, the Association of Equipment Manufacturers, and BtoB magazine. He is responsible for the magazine's Buying Files.