The mood in a recent meeting discussing the impact that the implementation of air-quality regulations would have on the market value of used Tier-4 equipment was pretty glum. The feeling was that the new generation of complex and more expensive machines would not be as keenly sought after in less-regulated international markets. Auction prices would therefore be lower, and the market depreciation experienced by fleets would be a lot higher. Doom-and-gloom numbers regarding rate increases were thrown about, and everyone thought that we would have to keep machines a lot longer in order to recoup additional owning costs. Everything said was true. The used equipment market is likely to change as used machines with Tier 4-Final engines start coming up for resale. Rates will, in all likelihood, have to change. The key question, though, is “How much?”

Dire, off-the-cuff predictions are dangerous. We should not panic. Let’s do the numbers, and see what is likely to happen.

Section 4.2 of my book, “Construction Equipment Economics,” contains a detailed rate calculation, and Section 5.1 has lots about the residual market value of used equipment. Let’s test the predictions made in the meeting by using an example rate calculation to see what will happen if auction prices fell 20 percent, 40 percent, and 60 percent below the residual market values used in the book. Every situation is, of course, different, and the calculation depends on the assumptions made and the characteristics of the machine being analyzed.

A Sample Calculation

Machine Data

- Purchase price: $118,000

- Expected useful life: 5 years; 10,000 hours

- Residual market value at end of life: $30,400

- Interest and other owning costs: ~$10,000 per year

- Total owning cost, estimated: $14 per hour

- Total repair parts and labor at end of life (TRPL): 110% of purchase price

- Fuel costs: 125% of TRPL

- Other operating costs: 65% of TRPL

- Total operating cost, estimated: $40 per hour

- Total owning and operating cost, estimated: $53.50 per hour

Results

Residual value assumption Rate to cover depreciation Owning & operating rate Residual value at sale Original data $8.80 $53.50 $30,400 20% drop $9.40 $53.90 $23,600 40% drop $10.00 $54.20 $17,700 60% drop $10.60 $54.60 $11,600

Figures used in the example machine are given in the nearby table. Compare them with your situation, and analyze your own numbers if your data differ to any material extent. The rate calculation was based on residual market values derived from prices paid at auction for similar machines at various ages.

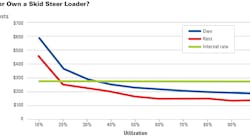

The fact that the meeting spoke about the impact that lower residual market values would have on both hourly rates and economic life means that it is necessary to do a full rate or “sweet spot” calculation to see how costs vary with age, and thereby determine both the magnitude and timing of the “sweet spot.”

Using CEMP’s spreadsheet-based “sweet spot calculator,” we analyzed costs based on the various residual values as they are affected by auction price. (The calculator is available at www.cempcentral.com/small-tools.) The results obtained with age and utilization fixed at 5 years and 10,000 hours are also given in the table.

When taken over the full life cycle of the machine, differences in residual value don’t have much of an effect on owning and operating costs. A drop in residual value from $30,400 to $23,600 ($6,800) spread over a full 10,000-hour life cycle comes to $0.68 per hour, or close to the difference between the $8.80 per hour and $9.40 per hour in the second column of the table.

The difference is also small when using the sweet spot calculator. Those calculations confirm that lower residual values do produce longer economic lives, validating the concerns expressed in the meeting. But, again, the difference in economic life produced by using the original auction data and the 60-percent reduction is little more than a year—certainly within the limits of our ability to estimate optimum cost and life. Declines in auction prices will change equipment rates, but they are likely to be small.

Now let’s turn to the black line in the graph, as it adds insight to what is probably behind the concerns expressed at the meeting. The black line represents the accounting book value of the machine. It shows that we are likely to harvest a gain on book value of $12,700 when we sell the machine at 10,000 hours if the residual market value follows the green line ($30,400 minus $17,700 equals $12,700). Many equipment managers have come to rely on this gain from year to year in order to balance their equipment account. If residual market values go down, then this will disappear. Equipment managers could find themselves “upside down” (see the maroon line).

To avoid losses on book values, fleets must incorporate concerns about lower residual market values into accounting depreciation policies and into expectations regarding residual market values. It is much better to adjust these policies and recognize the additional loss in value in small increments over the full lifecycle of the machine than it is to take a significant and unexpected loss on book value when it comes time to sell the unit.

Although the concerns about Tier 4 residual values are valid, there does not seem to be a need to dramatically increase rates in response. We can and should do the numbers, plan for the impacts, and make good decisions.

Here are five actions that will put your fleet in a good position when it comes to setting rates and managing the new generation of Tier 4-Final machines:

1) Improve your best practices and look after them a whole lot better. The technology will demand it.

2) Prepare to keep machines a little longer. Higher purchase prices and possibly lower residual market values mean that depreciation will be higher. Spread the cost over more hours to reduce the impact on your hourly owning cost rates.

3) Adjust your book depreciation to reflect the longer lives and lower residual values, and thereby reduce the chances of being upside down when it comes time to sell.

4) Know the sweet spot. Sell wisely and sell at the right time.

5) Never forget that owning costs are largely fixed when you ink the deal, and that the only way to produce competitive hourly owning cost is to increase utilization.