Commercially viable heavy electric trucks are still in the future, but when they arrive they’ll claim the same attractive attributes. That doesn’t mean diesel-powered trucks will disappear soon; most truck operators are necessarily conservative and will be reluctant to buy electric vehicles, or EVs, until their advantages are so clear that they can’t afford not to.

Like the transition from horse-drawn conveyances to internal combustion engines in the early 20th century, revolutionary products, including electric powertrains, are coming from non-traditional truck builders. Nikola Motors, founded by a relatively unknown visionary, Trevor Milton, and Tesla Motors, headed by Elon Musk, famous for his Tesla electric autos and SpaceX rocketry, have said they will start production on their electric highway haulers by late this year. Tesla’s Semi-Truck will be a straight battery-electric tractor, supposedly with enough range for up to 600 miles. As with his Tesla automobiles, Musk intends to set up a network of “superchargers” to replenish energy in the Semi-Trucks’ batteries.

Nikola’s Model Two will use a hydrogen fuel cell to generate electricity that will run its motors, and is thus a hybrid. Milton says he will set up hydrogen generating stations along major Interstates to fill the pressurized tanks of his Nikola heavy trucks. Fuel cells can be made to use diesel fuel, so why not capitalize on an infrastructure already out there? Because hydrogen is cleaner, he has said, and he wants to jump directly to an H-based future. He reportedly will also offer all-electric trucks for local use. When he announced his futuristically styled Nikola One prototype two years ago, Milton also showed drawings of a conventional-cab tractor meant for vocational use, but that appears to be shelved for the time being.

Transpower, a startup firm that has converted Internationals to electric power and is now using Peterbilt glider-kit chassis, has e-tractors working in drayage service out of southern California seaports. Transpower is also working with other firms to develop other e-trucks. Thor has an ET-One truck testing on SoCal streets. MotivPower, still another California venture, has electric buses in service and at least one e-trash truck on test in Chicago.

Old-line builders are also in the e-game. Cummins, synonymous with “diesel,” two years ago announced the Aeos electric powertrain that it hopes to sell to established original equipment manufacturers, though no announcements have come since. Perhaps the most likely customer for the Aeos is Navistar International, a big user of Cummins diesels, but its link-up with Volkswagen could instead bring componentry from VW’s electric-vehicle activity in Europe over here. Other domestic builders are partnering with their European and Asian affiliates and/or developing their own powertrains using their own resources.

Mack Trucks has placed a pair of battery-electric LR-model trash collection trucks into street testing in the East. One is going to New York City’s sanitation department and the other to a major trash-management company, said Jonathon Randall, senior VP, sales and marketing. The LR BEV is powered by two 130-kW motors producing a combined 496 peak horsepower, and peak torque of 4,051 lb.-ft. is available from zero rpm. Power is sent through a two-speed powershift transmission and put to the ground by a pair of proprietary S522R 52,000-pound rear axles. The Mack LR BEV features a copper-colored Bulldog hood ornament, signifying that it’s an electric vehicle.

All accessories of the LR BEV (for battery-electric vehicle), including the hydraulic systems for the Heil DuraPack 5000 body, are electrically driven through 12-, 24-, and 600-volt circuits. Four advanced lithium-ion batteries called NMC (for lithium nickel manganese cobalt-oxide) store the electric power for the motors, and are charged through regenerative braking, which happens often on a trash collection route, then fully replenished by plugging into a 150-kW charger at night. This could be the model for powering the drum of a concrete mixer, Randall said, though time will tell if it would be suitable for that application, and if mixers would be suitable EVs. For instance, would they stop often enough for regeneration to help charge the batteries? Running strictly on city streets with their stop signs and traffic lights might do it, but frequent trips via freeways might not.

“We need to know the operation,” says Harry Trost, senior manager of product planning at Dana, which now produces a line of electric components. “Does it have multiple trips per day, could it be charged between trips, and at night? For a mixer, electric power could be used for turning the hydraulic pump for the drum, an electric-over-hydraulic system, and for multiple electrified accessories. There could be a primary traction motor, and smaller motors for the PTO and accessories like the alternator, air compressor, and the HVAC system. In a dump truck, an electric motor could power the hydraulic lift mechanism. In a full electric mixer, you could operate the drum electrically instead of hydraulically—it could evolve to that. If you could eliminate hydraulics, you’d also eliminate hydraulic leaks.”

Electric power available now for trucks

Dana, a long-established maker of axles and brakes, has a portfolio of electric drivetrain components now on the market. Trost says that 8,000 to 10,000 of those are working in China, where the government is pushing for clean-power solutions to the country’s notoriously dirty air in major cities. Dana-Spicer e-Axles, supported by inverters and controllers, are now employed in transit buses and “have a sight-line to concrete mixers, where batteries would fit, and dumpers would also be a good application,” says Trost. Like other likely candidates for electric propulsion, construction trucks tend to run locally and return home at night when their batteries can be charged.

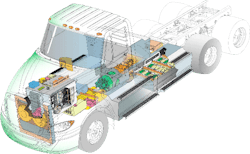

Most mixer trucks have frame space where battery packs could be saddle mounted. But many modern multi-axle dump trucks use lift axles ahead of the tandem drive axles, leaving little or no space for frame mounts. But since an electric truck would have no diesel or transmission, there would be room under the hood and cab to mount batteries and other electronic components, says Steve Slesinski, Dana’s director of global product planning. Dana’s electric motors can go in a driveline leading to an axle, adjacent to an axle differential, or in hubs. The axle approach is the concept used in Dana-Spicer e-Axles, which are essentially part of a drive axle.

Dana has invested money in Hyliion, a Pennsylvania start-up now in Texas. It used a Dana e-Axle on its first product in 2017, a powered axle for trailers. A motor and controller were mounted just ahead of the e-Axle’s differential. It’s also that way on a 6x4 HE version for road tractors, which Hyliion switched to at the urging of motor carrier executives, who argued that they would save more fuel if their busy tractors were e-equipped than if the electric axle were hung on a sometimes idle trailer. Electrical gear is placed farther forward of the e-Axle.

Hyliion 6x4 HE is, as its initials suggest, part of a hybrid-electric powertrain, not a straight electric. Thomas Healy, Hyliion’s founder, is pitching his product as a way to convert a 6x2 tractor into a 6x4, where the electric axle augments the mechanically driven one. Power for the e-axle would come from regenerative braking, not from an engine-driven generator. This arrangement could work on a construction truck, but Healy’s focus is now on highways rather than work sites. Hyliion’s system operates independently of a diesel tractor’s electric and mechanical systems, and can be removed and installed on another vehicle if necessary.

Batteries are the limiter for heavy truck development

Batteries have always limited the usability of EVs. This was true in the 1920s, when clean, quiet electric cars and trucks lost the technology contest to gasoline engines. Internal combustion engines made noise and spewed fumes, but could run as long as there was fuel in the tanks. Electrics needed hundreds of pounds of lead-acid batteries, which ran down after not many miles. They were fine for short trips or delivery routes in cities, but not feasible for the longer distances on regularly improving roads. EVs were also more expensive to buy, even if maintenance on them was comparatively cheap.

By the early 21st century, engineers had settled on lighter and more efficient lithium-ion batteries. They pack more energy in smaller packages, but have been prohibitively expensive. Diesel-electric hybrids produced and sold in the early to mid-2000s used lithium-ion batteries, but were financially feasible only through government grants and tax credits. Many had technical problems and weren’t operationally successful. Moderation in fuel prices undercut the business case for the hybrids, and they were withdrawn by the end of the decade. In the past five to 10 years, experts predicted that lithium-ion costs would come down as production steps up and volume increases. Engineers have meanwhile been working on “solid state” lithium-ion batteries.

Last December, Bloomberg NEF’s ninth annual Battery Price Survey found that the average price reduction for lithium-ion cells and packs “has been nothing short of remarkable: The volume-weighted average battery pack fell 85 percent from 2010-18, reaching an average of $176 per kilowatt-hour.” High demand is forecast in coming years, and “we expect the price of an average battery pack to be around $94 per kilowatt-hour by 2024 and $62 by 2030.” If this comes to pass, EVs would be price-competitive with diesel trucks without government subsidies, and operating and maintenance savings might clinch sales from many truck operators.

Ahead on the EV front

“In the next year, you will begin to see a range of medium-duty electric vehicles,” said Dana’s Slesinski. “Our core powertrain will support the full range.… Cost can actually be the same as a diesel powertrain with government subsidies, as is being done in California. For Class 8 trucks, larger batteries are needed, and there will be an incremental price increase.

“But the total cost of ownership for an electric truck will be 50 to 75 percent less with equivalent power. You do away with all the maintenance of a diesel—coolant hoses, fan belts, and diesel particulate filters, diesel exhaust fluid. And brakes: There are significant cost savings, by two-thirds, because regenerative braking cuts use of service brakes. In one transit bus in China, they didn’t have to touch the brakes for three years.”

In other OEM electric-truck activity:

Volvo has an e-VNL program in the works, and a direct line of communications with Volvo of Europe on e-developments.

Kenworth, partnering with Toyota, has a hydrogen fuel cell-electric T680 hauling containers out of the Ports of Los Angeles and Long Beach in California.

So does Peterbilt, with a Model 579EV, as well as a 220EV medium-duty chassis (using Meritor Blue Horizon electric components), and a 520EV trash-collection chassis, all shown off at events in the West.

Freightliner has an eM2 medium-duty box truck in test with Penske Leasing in California, and an eCascadia Class 8 has gone into delivery service. The eM2 has Dana TM4 equipment, Trost says.

California is a target state for electric truck use because of pressure from the state’s clean-air authorities and financial grants from them and other government entities. California’s Air Resources Board would like to do away with diesels, sees alternative fuels like propane and natural gas as attractive alternatives, but considers EVs as the future. History shows that as

California goes on automotive matters, so goes much of the nation.