Component Life Sketches Wheel Loader, Excavator, and Crawler Dozer Economic Life

|

Repair costs tend to rise with age, so equipment operations strive to extend component life to control a machine's hourly costs. As Construction Equipment's 2004 Lifecycle research suggests, that's a necessary strategy if you're getting less-than-average component life out of wheel loaders, crawler excavators and crawler dozers. And working to stretch engine, transmission, and hydraulic-pump life is important if you're hoping to replace machines before those components require major repairs. But industry averages suggest that after you've rebuilt a major component, controlling hourly ownership and operating (O&O) cost becomes more a matter of keeping utilization high than making components last.

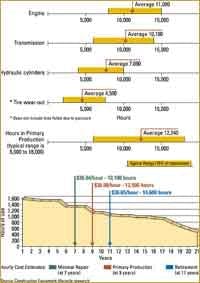

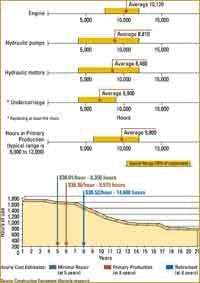

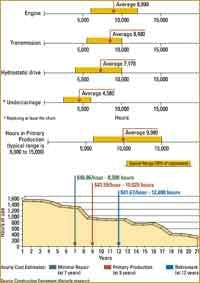

Construction Equipment conducted component-lifecycle research with contractors and materials producers to determine when most equipment users can expect to repair the major components in wheel loaders (2 cubic yards and larger), excavators (20,000 pounds and larger), and crawler dozers (75 horsepower and larger). Typical ranges highlighted in the accompanying graphs define the most densely populated 75-percent range of all responses to the survey questions.

Construction Equipment establishes utilization profiles for 28 machine categories with its Universe Study. Combining that data with average component lives to calculate O&O estimates for sample machines raises some interesting points about the economic life of loaders, excavators and dozers.

If a machine's annual hours drop steeply at some point (such as with crawler dozers at 7 years) O&O cost will rise throughout the rest of that machines' life even if the machine achieves above-average component lives. It may be more cost effective to replace that machine with a unit that will maintain high levels of utilization before investing in major repairs.

These calculations are based on average component lives, average parts and labor costs for major component repairs, and average hours of operation. The costs of small repairs such as hoses, belts, electrical components and the like are left out. Downtime created by these lower-cost repairs may also motivate earlier replacement. So component life and utilization would likely have to outperform the averages significantly in order to justify keeping these machines in primary production work until they need a second rebuild of major components.

In 7 years, the average 3.25-cubic-yard wheel loader with 170-hp engine and power-shift transmission has reached about 10,100 hours, and its annual usage has dropped off from the first 5 years at 1,500 hours per year to a still-respectable 1,300 hours per year. Major repairs are few, but if the owner can improve average tire life by just 500 hours, ownership and operating (O&O) cost drops nearly $1 per hour to $35.11.

Deciding to keep the machine into its 8th year results in a jump in hourly cost because the average production loader will then require engine, transmission, and axle rebuilds. But in years 9 and 10, the average machine works another 2,200 hours without incurring any more major repairs, bringing hourly O&O nearly down to the same level as before components required rebuilding. At 11 years, the average machine's hourly cost is a very respectable $36.65, but if smarter operation and better inflation-pressure management could eke out another 500 hours on each set of tires, O&O cost would be $36.01—lower than the cost before major repairs.

Nevertheless, average hourly costs for loaders level off through 17 years of age. Two important factors work in favor of contractors relying on wheel loaders for primary production even after 15,000 hours. First, the lives of major components such as engine, transmission and axles, on average, stretch to 10,000 or 11,000 hours. Second, wheel loaders' hours of use per year remains fairly high for 13 years, and averages more than 1,000 hours per year in the period from the first rebuild to 15 years. So after the engine, transmission, and axles are rebuilt the first time, O&O cost remains fairly constant even after 15 years.

Contractors take the average hydraulic excavator out of primary production at about 6 years, or 9,800 hours of use. With average component lives, only the engine is untouched. In year 8, the engine will need to be rebuilt and the machine's annual hours of use begin a steep slide that doesn't end until year 11 when usage has fallen to 800 hours.

Once an excavator's major components have been rebuilt, its operating costs tend to level out somewhat. But with annual hours of use dropping off and fast-declining residual values, the average excavator's total ownership and operating (O&O) cost creeps steadily upward. By the 8th year, hourly cost for a 53,000-pound machine with a 153-hp engine is 50 cents greater than it was at year 5, before the engine and hydraulic pumps required rebuilding. Even though year 9 typically won't require additional repair costs, falling utilization and residual value conspire to drive hourly cost up another 25 cents. And by the 10th year, the machine has run about 14,500 hours and hourly cost is $1.65 higher than before the rebuilding started.

The big challenge to beating average excavator costs with maintenance is that you have to add nearly 1,000 hours to the life of hydraulic pumps and motors or to undercarriage to have any real effect. For example, if undercarriage outlasts the averages by 500 hours, then O&O cost at 10 years is 70 cents per hour below average, but it has increased 20 cents over year 9.

It's likely that the most manageable variable in the excavator operating-cost equation is hours of use. For example, if annual hours in the 7th and 8th years are only 100 more than average, O&O cost drops to $37.99—below its pre-rebuild cost.

By the time the average machine is retired or replaced—at about 12,500 hours or 12 years—hourly cost has come down to $41.67. Annual hours of use are hovering just over 800, which is nearly half of the machine's first year of utilization. If you can beat the average engine life by just 50 hours, making them last more than 10,000 hours, then keeping machines into the lower-utilization 8th and 9th years produces O&O cost of $42.59—which is still $1.60 per hour higher than replacing units after the high-hour 7th year.

You beat the sell-at-7-years numbers by holding utilization near 1,200 hours per year and extending undercarriage life by 500 hours. Combined, the machine reaches more than 10,600 hours in the 9th year, and hourly cost drops to $40.42. The questions remain, though: How much control do you have over utilization in the 8th and 9th years of a machine's life? And can you consistently extend undercarriage life by 500 hours?