On the Docket: Fleets Expand, Replace

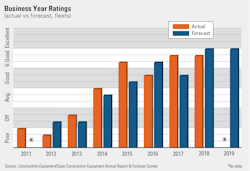

Business continues to boom for organizations that use construction equipment fleets, according to those who manage these assets. With 2016—the hotly contested-election year—as the exception, equipment managers have reported “very good” business for three of the past four years. Last year was also the first year in several where actual business performance met expectations from the previous year.

About the same time managers were rating 2018 as a business year, the Associated General Contractors of America reported that construction spending for the first nine months of the year was up 5.5 percent. Growth is broad and national, according to AGC’s chief economist, Ken Simonson: “Construction spending has increased among nearly every project type and geographic area [in 2018],” he said.

Equipment managers expect 2019 to bring more of the same, projecting it to be a “very good” business year. Contract volume bears that out. In 2017, volume resoundingly beat expectations, which encouraged perhaps a bit too much enthusiasm for 2018. Last year, although recording a strong gain, volume fell short of what equipment managers had expected.

The net for contract volume in 2018 (measured by the percentage reporting increases minus the percentage reporting decreases) was 35.9 percent, matching the number recorded in 2017. The forecast for 2018 was higher, a net of 52.9, but managers are not deterred in their optimism: The net for 2019 contract volume is 54.4 percent, with 62.4 percent expecting increases and 8 percent expecting declines.

About three-quarters of fleet managers expect bid prices to increase next year, with about one-quarter expecting them to stay the same. This is a slightly less aggressive outlook than recorded in 2018, which was the highest in several years. Expectations for last year called for increased bid prices with a net of 86.7 percent; for 2019, the net is 73.1 percent.

Looming over all 2019 predictions are the potential dampening effects of issues such as tariffs, equipment price increases, and construction labor shortages. Fleet asset managers are planning accordingly: Fleet-expansion rates and replacement rates continue strong, maintaining trends begun several years ago.

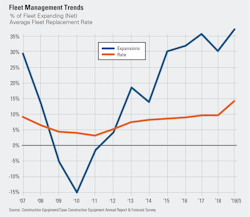

Equipment managers registered a fourth consecutive year of strong fleet expansion, with a net of 30 percent. More growth is anticipated. The fleet-replacement rate also stayed high in 2018, but the forecast for 2019 would set a record if managers follow through.

With contract-volume expectations continuing strong, equipment managers must ensure that the equipment needed to accomplish the work will be available. Acquisition strategies and replacement planning play key roles, as equipment rates contribute a major portion of bid pricing.

Fleet expansion rates have slowly rebounded from the depths of 2010 and returned to pre-Recession levels in 2015. Since then, managers have strung together four consecutive years of net numbers in near 30 percent. In 2018, 36.8 percent of respondents said they would be expanding their fleet sizes, and 6.6 percent decreasing, for a net of 30.2 percent. Expectations for this year are a net of 38.4 percent, with 43.2 percent expecting to increase fleet size minus 4.8 percent decreasing.

Machine replacement rates are another indicator for fleet managers. For the fourth consecutive year, that rate has been higher than 9 percent, with managers reporting 9.7 percent in 2018. This was below the expected replacement rate—10.7 percent—but did not prevent managers from forecasting an even higher rate for 2019: 13.8 percent. If met, this rate would be the highest recorded since the 1990s.

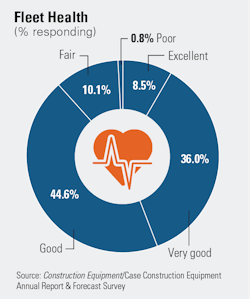

These metrics—expansion and replacement—provide insight into a fleet’s capability to stay healthy. Since 2012, the percentage of equipment managers labeling their fleets in “excellent” or “very good” health has steadily risen from 33 percent. In 2018, about 45 percent of respondents reported “excellent” or “very good” fleet health, up from 2017. The percentage of fleets in the unhealthy spectrum, “fair” or “poor,” remained statistically the same, dropping slightly below 11 percent in 2018.

Fleet health remains strong, with 44 percent of managers labeling their fleets in “excellent” or “very good” health, a number identical to 2017. The percentage of fleets in “fair” or “poor” condition also stayed the same, for the third consecutive year, at 11 percent responding.

Pressure on equipment prices, which this year includes tariffs as well as increases designed to offset emissions and technology enhancements, has forced managers to alter their acquisition strategies. About one-quarter of respondents said increased acquisition cost will have no effect on their plans for 2019, and another 17 percent do not know how prices will affect plans. About 16 percent will increase their new-equipment budgets to accommodate price increases, and another 16 percent said they will buy fewer machines. Twelve percent will buy used rather than new, and 12 percent will rent rather than buy new. (Respondents were limited to one choice in responding to this question.)

Price increases may be driving more fleets to finance, too. The percentage who use outright purchasing as a strategy dropped from 53 percent to 42.4 percent; the percentage who purchase by financing rose to 45 percent from 40.6 percent. Rental, rental/purchase, leasing, and lease/purchase remain as viable strategies used by equipment managers.

Trends in short-term rental—measured in total rental machine hours—remain consistent with past years. About three in 10 will increase their use of short-term rental, and about half will keep it the same as last year.

Managers are more comfortable with workforce levels in 2018 than they have been in previous years. Half of respondents said overall levels stayed the same as in 2017. On the service and maintenance side, two-thirds of respondents said they did not change the number of employees. One-quarter increased their maintenance force, 8 percent decreased.