Dire Days for Distributors

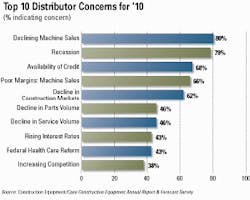

1) Declining machine sales. New machines are not moving because the construction markets are not moving. End-users are not using up their machines, so there's no replacement demand. The used market is hot, but much of the iron moving through auction houses is from distributor and rental fleets. There's no indication that trend is abating.

2) Recession. Toby Mack, president and CEO of AED told us last month, "While the broader economy may have begun to recover from the great recession, our industry is still in a depression." The construction sector is not rebounding, it is not recovering. Our industry faces high unemployment, and industry analysts fear it will continue to rise.

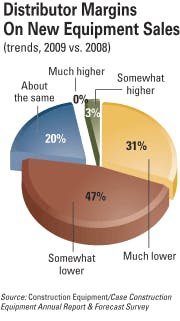

4) Poor margins. Economics 101 says prices follow demand, heading south in this case. Although 20 percent of distributors said they were able to maintain margins in 2009, 31 percent said margins were "much lower" than in 2008. Only so much overhead can be cut before declining prices eat up slim dealer margins. More labor cuts loom, according to one technician. "We're down to 32 hours, and a lot of people will possibly get laid off soon," says Mark Bjork.

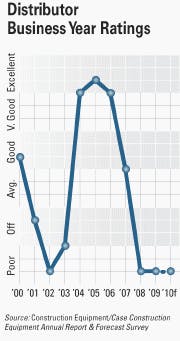

5) Declining construction markets. Markets are not forecast to rebound until late 2010. No projects, no machines at work, no new machines needed. "I work mostly on paving equipment," says technician David Deck, "and most of it is sitting still. We normally have a line out the door with customers waiting for them to be worked on." Twelve months ago, distributors reported the worst year since the recession that followed 9/11. Unlike 2002, though, distributors had no expectations for a moderate bounceback the following year.

Twelve months ago, distributors reported the worst year since the recession that followed 9/11. Unlike 2002, though, distributors had no expectations for a moderate bounceback the following year.