Equipment managers in our 2021 Annual Report and Forecast expected this year to be a challenge, although the unknowns diminished confidence in any predictions for business or fleet management. Restrictions slowed many state economies, but “essential” construction continued. The backlog pipeline is leaking, however, as demand for new construction—particularly on the nonresidential side—remains weak.

See the full industry report in the 2021 Annual Report & Forecast.

Following the events of March 2020, fleet managers recalculated their fleet plans for the remainder of the year. They are doing the same this year.

Fleet size is diminishing for about one in five equipment managers, with 19.8 percent saying they will be decreasing fleet size this year, compared to 8 percent who said the same thing in January. Yet 25.2 percent are increasing their fleet size, for a positive net (percentage increasing minus decreasing) of 0.5 percent compared to the 19 percent forecast for the year.

Covid continues to affect fleet acquisition plans, with one in four respondents saying that acquisition plans are on hold. Some are renting and leasing more than last year, and slightly more than half (52.7 percent) are not adjusting their plans. Some 7.2 percent of fleet managers say they will be selling equipment.

Overall fleet health has declined, too. In January, 52.7 percent of respondents said their fleet was in “excellent” or “very good” condition. Mid-year, that percentage has dropped to 36.5 percent.

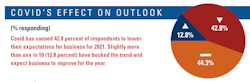

The coronavirus continues to soften business expectations for 2021. Although 12.8 percent of respondents say expectations have improved, 42.8 percent of respondents have lowered their expectations for the year.

The percentage of respondents rating the business year as “excellent” or “very good” is 49 percent, compared to a forecast for 2019 of 52.5 percent.

Construction Equipment sent email invitations to select members of our audience who buy, specify, or influence purchases of equipment. We asked about business and equipment-fleet trends. Results and analysis are provided as a service to the industry through the partnership of Construction Equipment and Case Construction Equipment.