Capital Expenditures Create a Commitment

Every dollar received in a capital expenditures (capex) budget must be returned to the company treasury one way or another. In “The Depreciation Cycle,” we described that process.

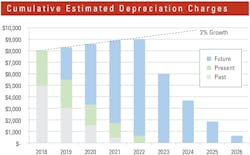

Above: This table shows cumulative estimated depreciation charges for the years ahead as well as the portion of these charges that come from the past, present, and future.

In “Maintaining the Capital Value of Your Fleet,” we stressed that depreciation charges are largely predetermined and calculated according to generally accepted accounting principles and that decisions regarding capital investments should not be taken without due consideration for the trailing impacts of past decisions. Now we’ll see how to develop a long-term capex plan that accommodates decisions taken in the past and provides the steady flow of the depreciation charges required to complete the investment cycle and ensure a successful future.

Most companies establish clear and relatively simple policies to determine the deprecation charges required to write down and recover the capitalized value of the equipment assets. These policies are frequently uniform across the whole fleet and, when this is the case, make it relatively easy to estimate future depreciation charges by applying the policy against the total capital expenditure for a given year. When this is not the case, a longer but no more complex unit-by-unit calculation is necessary. Regardless, it should be possible to predetermine the depreciation charges likely to be charged against the equipment account by defining the depreciation policy and applying it to the capital expenditures made in a given year.

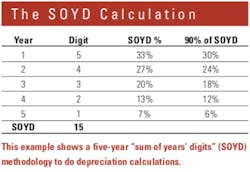

The first column is the year in question. The second column is the remaining life attributed to the machine (digit), and the third column is the SOYD% for a given year calculated as required by the methodology (for year 1, SOYD% is 5/15, or 33 percent; for year 2, SOYD% is 4⁄15 or 27 percent). The last column is 90 percent of the calculated SOYD% to allow for the fact that the company assumes a 10-percent residual book value. This is the percentage factor that is applied to the capital expenditure made in a given year in order to estimate the depreciation charge for that year.

The table below, “Estimating Depreciation Charges,” shows the spreadsheet used to estimate the depreciation charges in a given year based on the capex spent or planned to be spent in a given year. It requires an understanding of what is in the past, what is in the present, and what is in the future.

Rows 3 to 6 of columns A and B list years past and the actual capex expenditure made in those years. Columns C to F of these rows show the trailing impacts of these past decisions. Cell C3 shows that $406 of the 2014 capex spend (6 percent of the $6,768 actual spend) remains to be recovered in 2018. Cells C4 and D4 show that the last two years of the 2015 capex spend remain to be recovered in 2018 and 2019. ($1,049 equals 12 percent of the $8,742 spend, $525 equals 6 percent of the $8,742 spend.) Rows 5 and 6 repeat the process for the capex spent in 2016 and 2017. The values in the gray cells from C3 to F6 clearly show the impact that past capex expenditures have on the depreciation charges that must be recovered in the years 2018 to 2021.

Row 7 is the present. We plan to make capital expenditures totaling $10,100,000, and this will have to be recovered in the form of the annual depreciation charges set out in the green cells C7 to G7. ($3,030 equals 30 percent of the $10,100 plan, and so on.)

Rows 8 to 11 look to the future. They show the capex expenditure planned for the years ahead and the estimated depreciation charges based on these expenditures. The calculation is the same: Multiply the planned capex budget by the depreciation percentage factor for a given year to determine the portion of the capex budget that will be levied against the owning side of the equipment account in that year.

The graph at the top of this article brings it all together by showing the total of the estimated depreciation charges for the years ahead as well as the portion of these charges that come from the past (gray), the present (green), and the future (blue). Only the first five bars are valid as estimated charges because 2023 and on will be impacted by capex budgets set for those future years.

Three things are worth noting. First, fully $5 million of the estimated $8 million in depreciation charges that will need to be recovered from the owning side of the equipment account in 2018 will come from decisions made in years past. This drives home the fact that capex decisions are long-term decisions. They create commitments that must be recovered through fleet utilization years into the future.

Second, the table and the graph make it possible to set capex budgets with a full knowledge of how depreciation charges will fluctuate in the future. Our example and the capex budgets planned for the next four years show that charges will grow steadily from about $8 million in 2018 to about $9 million in 2022. This represents a growth of approximately 3 percent per year over the next four years. The question is, will the volume of work put in place and the income to the equipment account grow sufficiently to cover the increase in depreciation charges? If not, how can we better balance our capex budgets and resulting depreciation charges against future workloads?

Third, the graph and the table used in the calculations show that it is both possible and desirable to set capex budgets and estimate resulting depreciation charges well into the future. The example is simplified, but the principles remain the same: Determine the future impact of present commitments, and know how these stack up to define the future. The capex of today is the depreciation charge of tomorrow.

For more asset management, visit ConstructionEquipment.com/Institute.