Equipment managers continue to be slow to integrate Tier 4-Final machines into their fleets. Current machines still have useful life in them, and concerns persist around a generation of upgrades that include new technologies and unknown maintenance requirements.

This past fall, as part our Annual Report & Forecast, we asked subscribers about how Tier 4-Final machines are affecting fleet-replacement plans. One in four equipment purchasers who responded to the survey said they are not yet buying Tier 4-F machines, and only 8.6 percent said they are generally prepared for the equipment.

Higher acquisition cost for Tier 4-F equipment concerns nearly half of equipment managers, with 47.7 percent of respondents citing it. In a presentation at the 2016 annual meeting of the Association of Equipment Manufacturers, consultant Eli Lustgarten said regulatory cost increases tied to Tier 4-Interim and -Final drove up equipment prices a minimum of 16 percent to 18 percent.

About 40 percent of respondents say overall maintenance is a concern, with additional concerns raised around diesel particulate filters (DPFs), diesel exhaust fluid (DEF), and diesel fuel cleanliness.

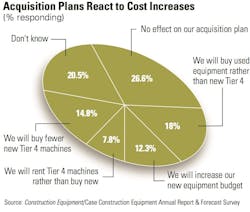

When asked how higher costs have affected plans for 2017 acquisitions, 26.6 percent of fleet managers said their plans have not changed. Another 12.3 percent said they will respond to cost increases by boosting their new-equipment budgets.

Others, however, are adjusting their plans.

The percentage of those who say they will buy used equipment rather than new Tier 4-F machines increased compared to a similar survey conducted in 2015, to 18 percent from 14 percent. On the other hand, the percentage saying they will rent Tier 4-F rather than buy new decreased from 11.4 percent to 7.8 percent.

Also increasing is the percentage of managers who said they will buy fewer Tier 4-F machines because of cost considerations. About 15 percent said they will do this, up from 7.7 percent last year. One-fifth of respondents do not know how they will respond to cost increases, down from 25 percent in 2016.

In addition to acquisition costs and maintenance uncertainties, fleet managers said they were concerned about electronic engine controls and training.