Advances in Technology Drive GET Market Growth

A recent market analysis by Wakefield Research suggests that technological improvements are contributing to extended lifespans for ground-engaging tools (GET), which may drive short-term growth, but will ultimately lead to a slowing replacement cycle.

“Over the next five years, the GET products market is expected to grow steadily as a result of increased construction activity and advancements in tool design,” according to the report. “While replacement rates may slow in the long-term as equipment becomes more durable, the improved range of products will carry a higher price point and will result in increased demand for more-specific GET.”

How do you choose the right GET?

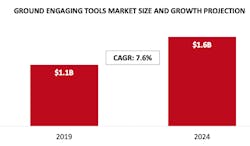

Wakefield identified the global GET market as worth $1.1 billion in 2019. It suggests the market will grow to $1.6 billion by 2024. It cites increasing construction and mining activity, as well as improved GET product design.

Some of those advances, the report says, will entail a move from weld-on to mechanically attached GET. The mechanically attached tools allow for quicker replacement, and so-called “hammerless” tools can be swapped out by one person without further tools.

The report identified original equipment manufacturers (OEMs) that create their own replacement parts and other parts makers that do not manufacture heavy equipment. OEM identified in the report include Caterpillar, Hitachi, John Deere, Komatsu, and Leibherr. Aftermarket suppliers included Columbia Steel, Combi Wear Parts, ESCO, H&L Tooth Co., and Metalogenia SA.

Source: Wakefield Research