Sometimes steady wins the race; other times it puts the finish line a bit farther away. As fleet managers continue to face long lead times on new equipment, they are trying to do what they need to do with what they currently have.

The result, according to Construction Equipment’s mid-year report, is longer lifecycles and delayed replacement plans.

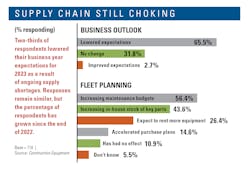

Manufacturers see no end in sight for supply chain shortages.

In our 2023 Annual Report & Forecast published in January, 52.4 percent of respondents expected to keep their fleets the same size this year as in 2022. Midway through 2023, that percentage has grown to 69.1 percent. Without the influx of new machines to replace those beyond useful life or prime economic life, fleet managers are pushing lifecycles. The use of rental remains in line with historical numbers, further suggesting that managers are extending fleet age.

Pushing fleet age should increase maintenance spending, and survey results bear that out. More than half of respondents (56.4 percent) are increasing their maintenance budgets. At the end of last year, 44 percent of respondents expected to increase budgets in response to supply constrictions. In addition, 28 percent said that they would accelerate purchasing plans in 2023 in order to have the machines ready to roll when the work came in. Midyear, that percentage has dropped in half, to 14.6 percent planning to accelerate plans. The work is in; the current fleet must handle it.

Fleet health seems to be holding out, however. The percentage of respondents rating their fleet health as “excellent” or “very good” remains comparable midyear to what it was at the end of 2022: 44.1 percent. This percentage is still below 52.7 percent reported in 2020 and 48.9 percent in 2021. Eventually, fleet age will catch up.

Organizations using construction equipment face supply issues in areas other than fleet, and the overall disruption is affecting the business outlook for 2023. Two-thirds (65.5 percent) of respondents said that their firm has lowered expectations for the year. Expectations for 2023 now are “excellent” or “very good” for 32.8 percent, down from 47.8 percent at the end of 2022.

Construction Equipment sent email invitations to select members of our audience who buy, specify, or influence purchases of equipment. We asked about business and equipment-fleet trends. Results and analysis are provided as a service to the industry through the partnership of Construction Equipment and Topcon Positioning Group.

About the Author

Rod Sutton

Sutton served as the editorial lead of Construction Equipment from 2001 through 2025.