Regulations, Funding Drive Water Market in 2023

By all accounts, 2022 was among the busiest years for the water and wastewater market in recent memory. The Infrastructure Investment & Jobs Act at the tail end of 2021 injected hope, optimism, and excitement into an industry that had not received investment on this scale since the 1970s.

See the complete 2023 Annual Report & Forecast.

But regulations surrounding per- and polyfluoroalkyl substances as well as a new domestic preference law for all federally funded infrastructure projects created headwinds while also dominating headlines. Despite those headwinds, however, water industry professionals have a positive outlook for 2023 and expect their budgets to increase, although inflation likely played a part in those responses.

The Water & Wastes Digest annual State of the Industry survey received 61 responses, a considerable drop in participation compared to prior years. Government administration and corporate managers (34 percent) and Operations (31 percent) accounted for the majority of respondents with Engineering (21 percent), Technical (8 percent) and Original Equipment Manufacturers (5 percent) rounding out the remaining respondents. As often is the case, the ages of the respondents skew to the older side of the spectrum with 45 percent being 60 years old or older. Those 50 to 59 accounted for 25 percent; 40 to 49, 16 percent; 35 to 39, 7 percent; and 34 and younger, 7 percent. Those who indicated they were 70 or older accounted for the remaining 10 percent, which is a drop of 5 points compared to last year’s survey.

Along the lines of age is the tenure of industry professionals. It comes as no surprise that with 60 to 69 making up the bulk of respondents that 30 or more years of experience (36 percent) was the largest response for career length. Interestingly, the next two greatest responses for this question were 10 to 19 years (25 percent) and less than 10 years (23 percent). The smallest portion was 20 to 29 years at 16 percent. This could simply be a statistical anomaly due to the survey response size, but it also indicates people with less industry experience are gaining authority in their roles to make purchasing decisions as 30 or more years of experience dropped by six points year over year.

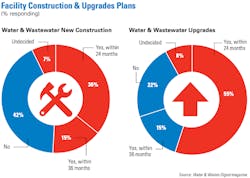

As for those purchasing decisions, 36 percent indicated that they will construct new facilities within 24 months—an increase of 12 points year over year—and 15 percent said that they will do so in 36 months—a drop of 3 points year over year. This suggests that the 36-month timelines have remained the same for a portion while others have more urgent construction. The answer for “No construction” fell 7 points year over year to 43 percent from 50 percent. As for upgrades, completing them within the next 24 months maintained the highest response rate (56 percent) year over year with an increase of 13 points. Upgrades within 36 months fell 6 points, suggesting a conclusion to construction timelines. In either case—new construction or upgrades—the injection of funding to the industry appears to be showing an increased attention on construction of facilities due to available funds.

In understanding the budgets of utilities, the three greatest budgeted items are Pipe/Distribution Systems, Pumping Equipment, and Sewer/Collection Systems. Just behind those are Sludge Management and Disinfection. Respondents also indicated that they will have an increase in their budget for 2023 (66 percent) or no change (28 percent) with 7 percent expecting a decrease. This change aligns directly with the increase in operational costs that utilities are facing as 93 percent witnessed an increase year over year. Comparing 2022 revenue to expected 2023 revenue, respondents who saw a decrease for 2022 are more likely expecting an increase in 2023.

That position indicates greater optimism for 2023 as well. For 2022, 15 percent of respondents said that the year was “very good,” and 23 percent expect 2023 will be “very good.” That increase appears to come from 2022’s “good” (54 percent) and “mediocre” (20 percent) responses. And not one respondent indicated that their organization’s health in 2023 will be “poor”; ’very good” (34 percent) and “excellent” (15 percent) make up the majority of responses.

Water equipment purchases

As for equipment or services to be purchased, the top five in order are pumps (33 percent), valves (27 percent), software (25 percent), and monitoring/metering technology (24 percent). Tied for fifth at 22 percent are structures, storage facilities, and filtration.

The Biden administration has placed an emphasis on lead service line replacement and the removal of PFAS from drinking water and wastewater systems.

In fact, PFAS received not only an updated Health Advisory in June, but also was primed for a Maximum Contaminant Level and Maximum Contaminant Level Goal in December. PFAS came to overshadow the lead service line conversations on a national scale with talk of impending regulations in addition to an EPA proposal to name the family of contaminants hazardous substances in accordance with the Comprehensive Environmental Response, Compensation and Liability Act (CERCLA) also known as Superfund.

These chemicals have also been observed in biosolids, the solid byproduct from wastewater treatment commonly used as fertilizer across the country through land application. And the U.S. EPA is conducting a risk assessment on the human health impacts of PFAS chemicals in those biosolids when beneficial reuse as land application is used. The national conversation on these man-made chemicals will not end anytime soon.

Last year, utilities had to comply with the Lead & Copper Rule Revisions, which included required communications to the public. Add on the unstable regulatory environment around PFAS in both drinking water and wastewater applications, and it is easy to see a renewed focus on communications for these public utilities.

Federal regulations in water

Water and wastewater systems are challenged with how to communicate the nuance of these regulations to their customers. For example, the PFAS Health Advisories are orders of magnitude smaller than any other Health Advisories in history, which begs the question from utility customers: “Is my water safe to drink?” Unfortunately, for many water utilities, detecting at that level is not scientifically possible—let alone treating to that level—and the answer could induce panic in systems that are otherwise compliant and producing a healthy product.

In addition, a proposal from the EPA to designate two PFAS chemicals as hazardous substances has found opposition from industry leaders and experts. Although the intent of such a designation, as outlined by the U.S. EPA, is to hold polluters accountable, industry associations claim the language of the proposal would place liability onto water and wastewater systems, effectively declaring them Superfund sites.

One final complication on PFAS of note was a Department of Defense memo in the first half of the year that halted the incineration of PFAS-laden materials to await scientific research into its effectiveness. That research is being conducted by the U.S. EPA. Although this memo only affected DOD activities, it raised questions in the water and wastewater sector as that is the primary method of destruction and disposal of PFAS at this time.

Utilities are not the only entities in the market struggling to find a foothold in their regular activities due to regulations. Build America, Buy America (BABA) is a new domestic-preference law, which requires all infrastructure projects funded with federal dollars—regardless of funding amount—to ensure that equipment is at least 55 percent domestically manufactured.

The effective date for BABA in May only resulted in guidance in early November from the U.S. EPA. This lack of information gave manufacturers pause in fulfilling equipment sales. For some, this is due to equipment manufacturing outside the U.S., and others that manufacture inside the U.S. have components from international suppliers. Many pieces of equipment in the sector are highly complex with hundreds of components, and OEMs are uncertain how to calculate domestic production of their systems to comply with the new law.

Waivers have been established to overcome some of these hurdles, but without clear guidance from the Made In America Office on certain definitions and calculations, the industry may feel a lag in execution and a stretching of timelines in 2023, despite funding disbursements reaching the states.

That being said, funding has begun to reach states whose intended-use plans have been approved by the U.S. EPA. Illinois and New York each announced more than 10 projects to be funded with state revolving funds—the primary vehicle for federal funding in the sector—and some even qualified for principal loan forgiveness. There is still business to be found, so long as one can push through the regulatory headwinds to the finish line.