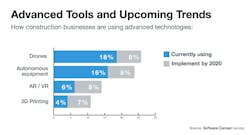

Some 26 percent of small to midsize construction businesses either are or expect to incorporate drones into the operations by 2020, according to Software Connect. The software consultants surveyed 158 construction industry professionals about technology and software usage.

Drones and autonomous equipment are the clear leaders when asked about new tools they are using.

Drones emerged as the leading trend. Nearly one in five (18 percent) of respondents are currently using drones for photogrammetry and mapping.

Drone technology is capable of dramatically reducing time and resources needed for such tasks: For instance, while a traditional surveyor would spend up to a month to survey a construction job site in detail, a construction company called Identified Technologies uses self-flying drones to complete the same work within minutes, greatly expediting project timeframes and reducing physical labor costs.

Goldman Sachs estimates that the construction industry will adopt drone usage more rapidly than any other commercial industry. Looking ahead, nine percent of our survey respondents say they will implement drone use in the coming three years.

The construction industry is adopting robots and autonomous equipment at a similar rate to drones.

Twenty-four percent of construction industry professionals say they will implement autonomous equipment by 2020. Self-driving equipment bring a number of benefits such as reduced costs, increased uptime, and even saving lives. In fact, 21.4 percent of worker fatalities in private industry in 2015 were in construction.

Despite all the potentials offered—improved collaboration, 3D modeling, as well as increased worker safety—augmented/virtual reality technology remains fairly cost-prohibitive.

Only a relatively small percentage of respondents said they are using augmented or virtual reality (6 percent). That said, in the coming three years, 10 percent will begin to use augmented or virtual reality tools.

3D printing had the lowest adoption rate in the survey. Only four percent of contractors use the technology today, and an additional seven percent plan to adopt it by 2020.

Technology budgets for construction

Technology spending is projected to rise. Eighty-two percent plan to spend the same or more over the next year.

Some budget will be allocated to new tech discussed above. However, in just the next 12 months, two out of five (41 percent) of respondents say they plan to buy or upgrade their construction management software (CMS).

Since construction software is in demand, let’s look at what professionals need out of their software.

Construction professionals want a lot out of their software. When assessing their options, the majority of respondents are looking for features related to project tracking (73 percent), job costing (72 percent), and project estimating (66 percent).

Still, functionality is only one factor when it comes to investing in new technology—respondents cited “ease of use” (37 percent) as the most important purchase consideration, even over functionality and cost. As construction companies often need to train staff and contractors across many field sites, it’s crucial that they can quickly train and onboard new users in any technology that’s used in widespread operations.

The majority use construction management software (56 percent). Unsurprisingly, construction management software users are much less likely to rely on manual methods for business operations (spreadsheets, pen, and paper).

However, even when construction companies do invest in technologies, they often run into problems that may prevent widespread adoption within the company. Most commonly, the challenges they face include:

Insufficient commitment of resources. While companies may initially invest in technologies, they don’t always plan a sustainable, long-term budget to manage and update the technology and train staff on its usage. As a result, ROI is lower than expected, and companies don’t maintain the commitment.

Obstacles in large-scale implementation. While a technology initiative may be a high priority in the head office, field staff and contractors are not always sufficiently trained in the tool’s usage and importance. Even if they are trained in the technology, crew members may consider the tools a hindrance to their established methods of labor. Construction professionals are demanding software ease-of-use likely to help bridge this gap.

Incompatibility with legacy systems. Construction companies often have an established technology framework for planning, modeling, and managing jobs, and their legacy systems may not be compatible with new integrations. As a result, such implementations are delayed until the point that it makes sense to replace the legacy tools.

A 2016 study from the UK-based BRE Academy found that a digital skills gap was a significant cause of concern, with respondents claiming that management skills were lacking at both an industry- and organization-wide level.

More than two-thirds of respondents to the BRE study said that institutions should do more to promote the technical and digital aspects of the industry. In the coming years, it’s clear that hiring employees with the ability to engage with technology tools in the construction field will be a key differentiator for leading companies.

As of late, construction businesses are especially open to cloud hosted software (typically 5 percent more likely than other industries). Why are construction companies more likely to look for cloud software? Perhaps due to changing job sites, or the need for mobile tech.

Mobile technology

Fifty-eight percent of respondents say their business at least “sometimes” relies on mobile or tablet-based applications. Also unsurprising, hosted/cloud software users were more likely to depend on mobile.

Hosted software and mobile tech go together like two peas in a pod. Especially when you throw in multiple devices and real-time reporting.

But how are contractors using mobile? Sage found the most common use cases included daily field reports, customer / job information, document management, job cost reports, and scheduling.

Fifty-one percent of respondents currently use BIM software (building information modeling), but more than half (59 percent) of BIM adopters report that they are less than thrilled with their software.

In some cases, the dissatisfaction may be based on the respondents’ lack of commitment to engaging with the BIM tool and encouraging widespread adoption throughout the company.

The McGraw-Hill Construction Report found that the more invested construction professionals were in making BIM software a key part of their processes, the more ROI they saw from the tool. According to their stats, just 13 percent of BIM users demonstrated very high engagement with the software—but 65 percent of this select subgroup saw ROI of 25 percent or higher on the software, as compared to just 20 percent of less engaged users. Of the less engaged group, two-thirds had negative or break-even returns on their BIM investment.

Conducted in September 2017, the “Construction Industry Technology Trends Report” is based on a survey completed by 158 construction industry professionals from small and medium-sized businesses in North America. The bulk of respondents came from the United States and 97 percent from companies with fewer than 500 employees.

--David Budiac is a Managing Partner at Software Connect. Used with permission.