Contractor Groups: Spending Up in October

Both the Associated Builders and Contractors (ABC) and the Associated General Contractors (AGC) conclude that construction spending rose in October.

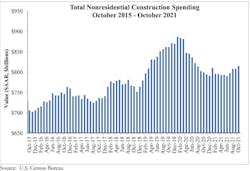

National nonresidential construction spending was up 0.9 percent in October, according to an ABC analysis of data published by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $814.2 billion for the month.

Spending was up on a monthly basis in 13 of the 16 nonresidential subcategories, with spending in the commercial subcategory virtually unchanged for the month. Private nonresidential spending was up slightly by 0.2 percent, while public nonresidential construction spending increased 1.8 percent in October.

“On the surface, there is much to be encouraged by in October’s construction spending data,” said ABC chief economist Anirban Basu. “Nonresidential spending is now at its highest level since July 2020 and has rebounded 3.1 percent since bottoming out in June 2021. Nonresidential spending expanded meaningfully for the month and those gains were spread across most subsectors. Data characterizing the two prior months were upwardly revised by a combined $27 billion, or 1.7 percent.

“But construction data do not adjust for inflation, and these spending gains are largely attributable to increases in the cost of delivering construction services,” said Basu. “Challenges that have suppressed nonresidential construction spending growth remain firmly in place. While lofty levels of investment in real estate would normally be associated with significant private construction volumes, many project owners have been induced to postpone projects because of elevated material and labor costs as well as widespread shortages."

AGC says total construction spending edged higher in October, as gains in public and private project types outmatched decreases in single- and multifamily residential outlays, according to its analysis of federal construction spending data.

Officials noted that public sector investments would likely rise in the near future because of the recently-passed infrastructure bill, but cautioned that labor shortages and supply chain problems were posing significant challenges for the industry.

“It is encouraging to see such a broad-based pickup in spending on nonresidential projects in the latest month,” said Ken Simonson, the association’s chief economist. “But the construction industry still faces major challenges from workforce shortages and supply-chain bottlenecks.”

Construction spending in October totaled $1.60 trillion at a seasonally adjusted annual rate, 0.2 percent above the September rate and 8.6 percent higher than in October 2020. Year-to-date spending in the first 10 months of 2021 combined increased 7.5 percent from the total for January-October 2020.

Among the 16 nonresidential project types the Census Bureau reports on, all but two posted spending increases from September to October. Total public construction spending rose 1.8 percent for the month, while private nonresidential spending inched up 0.2 percent. However, for the first 10 months of 2021 combined, nonresidential spending trailed the January-October 2020 total by 4.7 percent, with mixed results by type.

Combined private and public spending on electric power and oil and gas projects--the largest nonresidential segment--declined 0.6 percent for the month and lagged 2020 year-to-date total by 1.7 percent. But the other large categories all rose in October.

Highway and street construction spending increased 2.4 percent for the month, though the year-to-date total lagged the same months of 2020 by 0.8 percent. Education construction rose 0.2 percent in October but trailed the 2020 year-to-date total by 9.2 percent. Commercial construction--comprising warehouse, retail, and farm structures--was nearly unchanged from September to October but was 1.9 percent higher for the first 10 months combined than in January-October 2020.

Residential construction spending declined for the second month in a row, slipping 0.5 percent from the rate in September. Nevertheless, the year-to-date total for residential spending was 24.2 percent higher than in the same months of 2020. Spending on new single-family houses decreased 0.8 percent for the month but outpaced the 2020 year-to-date total by 25.9 percent. Multifamily construction spending dipped 0.1 percent in October but topped the 2020 year-to-date total by 16.6 percent.

Sources: ABC, AGC