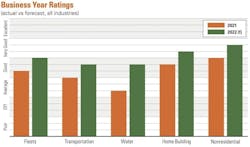

Construction markets improved last year compared to 2020, which is to be expected, but we have not yet returned to the levels reported in 2019. The business rating for 2021 was “good,” up from the “average” recorded for 2020 and matching the forecast made at the end of 2020.

The shining star among the vocations we track was nonresidential, reporting a “very good” 2021, up from an “off” 2020. On the other hand, water infrastructure continued to struggle, calling 2021 an “average” year after an “off” 2020. Both vocations expect 2022 to improve.

2022 Construction Reports

The industry as a whole expects 2022 to be better than 2021, forecasting a “very good” year.

Each of these markets is covered by Scranton Gillette/SGC Horizon publications, siblings of Construction Equipment.

All regions across the country considered 2021 a “good” year. Mid Atlantic and Pacific rebounded the most, each having reported an “off” 2020. The rest of the country improved from “average” in 2020, with the Mountain region standing pat with the same “good” rating it had in 2020.

Most regions (five of the nine) expect 2022 to be “very good,” further recovering from the pandemic and the responses to it. South Atlantic, Great Lakes, Northern Plains, and Southern Plains expect this year to be similar to last.

All regions and vocations, however, face supply chain slowdowns and ongoing labor shortages. Neither of these headwinds is expected to abate in 2022.

The Associated General Contractors of America late last year noted that contractors were starting to pass along increases in materials prices.

“After being battered by unprecedented price increases for many materials, contractors are finally passing along more of their costs,” said Ken Simonson, the association’s chief economist. “Meanwhile, supply-chain bottlenecks and labor shortages continue to impede contractors’ ability to finish projects.”

Historical Construction Business Reports

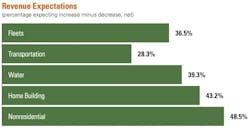

Contract volume bounced back in 2021, moving from a negative net percentage to positive territory. The net is computed by subtracting the percentage reporting a decrease from the percentage reporting an increase. The net for contract volume in 2020 was -6.3 percent, and the net for 2021 was 9.5 percent.

The net varied by vocation and region. The transportation segment of the industry reported a 2021 net barely positive, at 1.2 percent. On the other end was the nonresidential segment and its net of 25.5 percent. This year, every vocation expects contract volume to continue to roar, although some of that fuel will be inflationary. The industry reports a net of 41.1 percent, led by nonresidential’s 48.5 percent.

The most positive region in 2020 was the Mid South, with a net of 19.5 percent. On the other end was the Northern Plains, where contract volume recorded a net of 5.6 percent. Again though, expectations are high for 2022. The Mid South region expects a net of 53.1 percent, which means more than half of respondents expect volume to increase. Close behind is Pacific (net 48.8 percent) and New England (net 48.6 percent).

Above: Revenue grew in 2021 for construction, despite substantial headwinds, with a net of 9.5 percent. Respondents expect this year to be strong, with a net of 41.1 percent. Optimism is greatest among nonresidential and home building vocations, and it is weakest in the transportation market, with a net of 28.3 percent.

With expectations of volume increases, of course, come expectations that bid prices will increase this year. As an industry, the net for forecast bid prices is 62.6 percent. The transportation sector leads with a net of 82.8, which could be a combination of anticipated transportation funding as well as materials inflation. Inflation in homebuilding was prevalent in 2021, which may explain why bid prices are netting out at 51.4 percent in this vocation for 2022.

Supply has choked the flow of many construction materials, and that expectation continues through 2022 and perhaps into 2023. As a result, price increase expectations record a net of 59.6 percent for respondents. New England has the highest expectations, reporting a net of 72.0 percent, and the water infrastructure segments leads the vocations, with a net of 77.9 percent.

Competitive markets greet every vocation as we enter 2022, with a greater percentage of respondents describing their markets as “intensely” or “very” competitive: 69.1 percent for 2022 compared with 65.0 percent last year. The transportation segment faces the steepest competition, with 79.7 percent of respondents noting “intensely” or “very” competitive markets. This is up from 63.5 percent in 2021.

Overall firm health ticked up in 2021 over 2020. Some 72.1 percent of respondents described the health of their firm as “very good” or “good,” up from 69.9 percent in 2021. This is still far below the 80.0 percent who said the same in 2019. In the nonresidential segment, 78.8 percent described firm health as “very good” or “good,” but the water infrastructure segment recorded 67.6 percent describing firm health as such.

Annual Report & Forecast Methodology

Scranton Gillette Communications and SGC Horizon publish several magazines in the construction sector. Participants in the 2022 Annual Report & Forecast asked their subscriber bases about not only overall construction trends, but also trends specific to the sector in which they work. Each publication sent email invitations to its subscriber base, inviting participation in an online survey. Over 2,000 responded. Respondents by market include fleet managers, 283; transportation, 187; water infrastructure, 145; nonresidential, 198; and homebuilders, 1,250.

Case Construction Equipment partnered with Construction Equipment in presenting the Annual Report & Forecast. Case is a full-line manufacturer of earthmoving equipment.